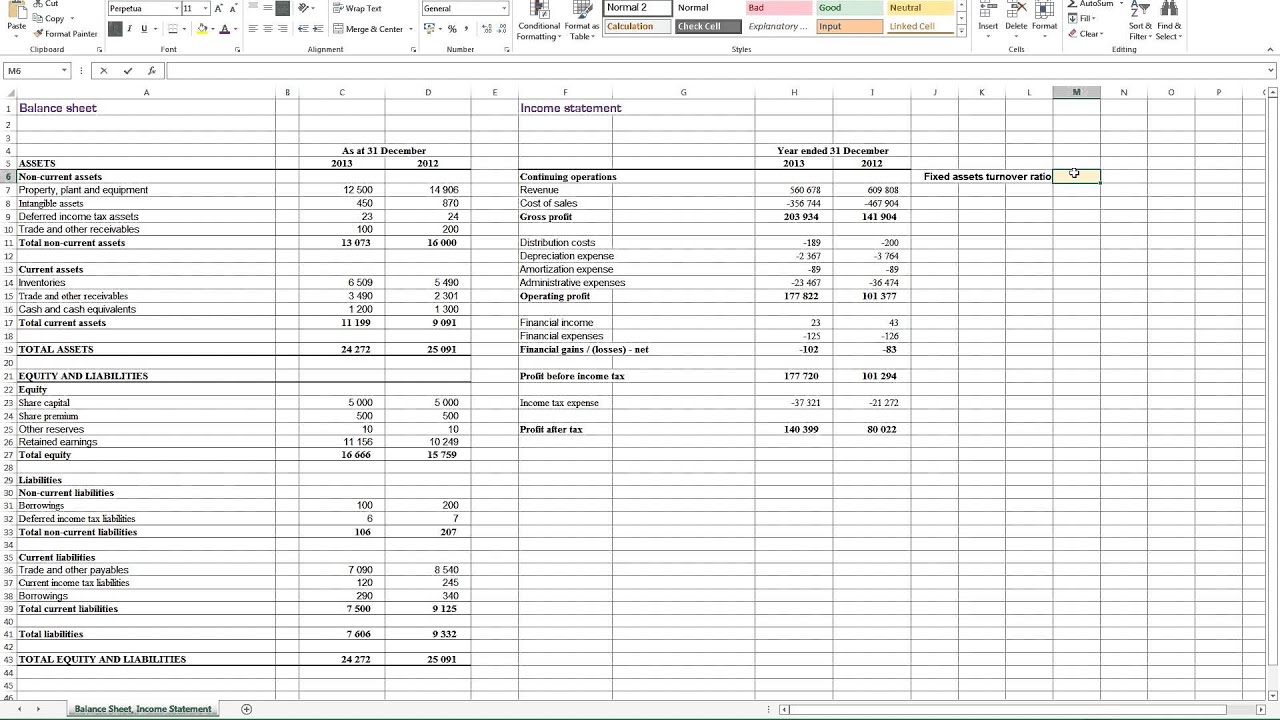

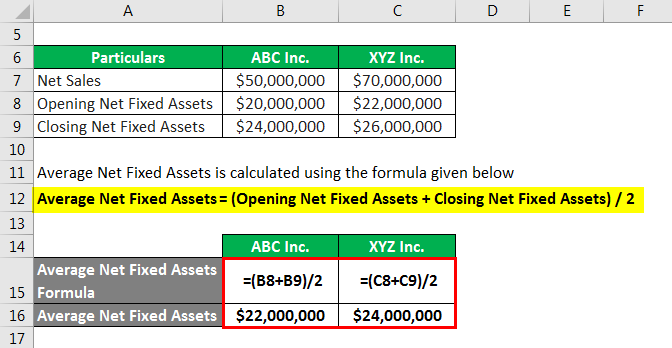

There is no precise % or Range that can be used to assess if a firm is effective at producing revenue from such assets. It shows that fixed asset management is more efficient, resulting in higher returns on asset investments. Fixed Asset Turnover Ratio Interpretation High Fixed Asset Turnover Ratioįor most firms, a high ratio is desirable. XYZ's fixed asset turnover ratio is calculated as follows: 9 lacs / 5 lacs - 2 lacs which give a 3:1 ratio. In the previous 12 months, sales totalled 9 lacs. Net sales are defined as gross sales, fewer refunds, and allowances.įor example, XYZ Company has 5 lacs in gross fixed assets and 2 lacs in cumulative depreciation. The amount of property, plant and equipment less cumulative Depreciation is referred to as net fixed assets. This ratio is derived by dividing net sales by net fixed assets over a year. The formula for calculating the Fixed Asset Turnover Ratio is as follows:įixed asset turnover ratio = Net sales / Average net fixed assets

It tells investors, lenders, creditors, and management whether the firm is making the best use of its fixed assets. Often it is computed on a yearly Basis, although it can be calculated over a shorter or longer duration if necessary. It is used to assess management's capacity to produce revenue from fixed assets. What is Fixed Asset Turnover Ratio? Updated on J, 483 viewsįixed Asset Turnover is a ratio that compares the value of a company's sales revenue to the value of its assets. Problems With Fixed Asset Turnover Ratio.Fixed Asset Turnover Ratio Interpretation.

0 kommentar(er)

0 kommentar(er)